- 14,995

- 4,264

- Joined

- May 26, 2003

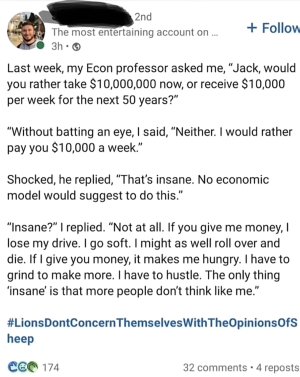

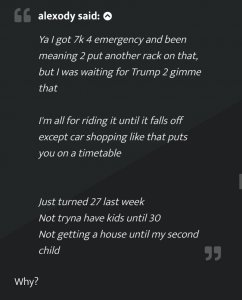

If you cant afford to buy something in cash (excluding a house) you dont deserve to have it, point blank.

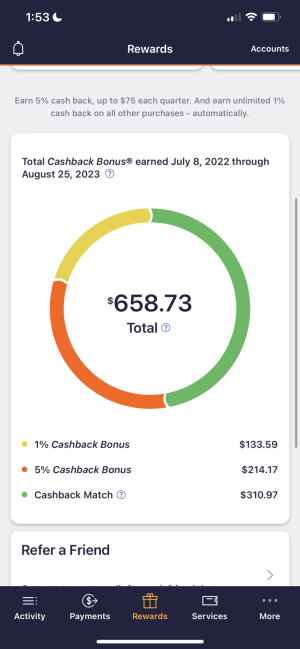

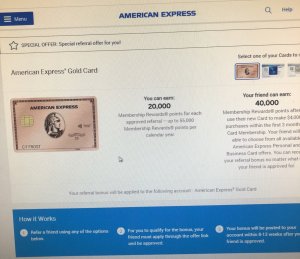

Your credit card should be used as a cash equivalent.

you speaking about Non Business expenses right? If not this is terrible advice lol. Even then one can make the argument that why buy a house when you can rent and avoid the headaches of home ownership because the days of buying a home and gaining 200k in equity are over.

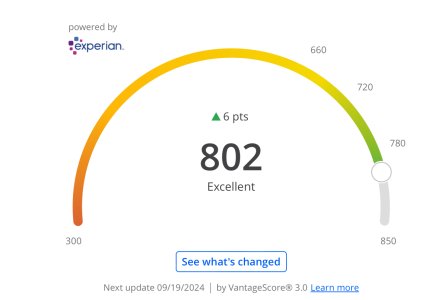

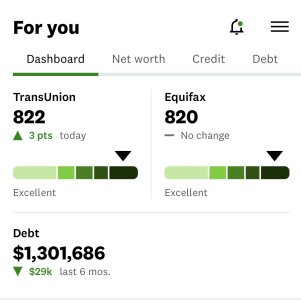

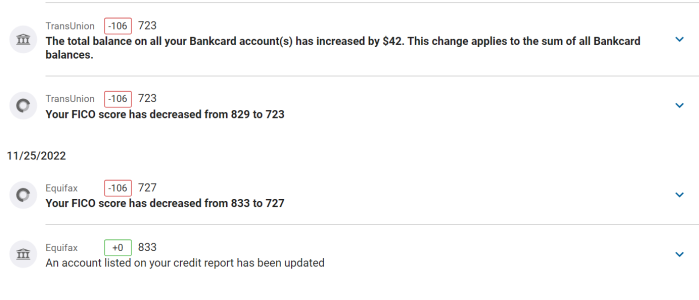

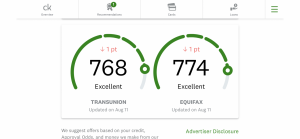

At the end of the day Credit can be used to your advantage if you understand it and its purpose.

All this 1920s use cash only logic is just as ignorant as the dudes who spend money they have because both parties dont understand the concept of credit.