antidope

Supporter

- 63,427

- 67,766

You know my struggle, mine is from The GapI would stay away from store cards like the plague! Those things are nothing but trouble. Used to have an Old Navy card and had nothing but problems too. IMO, with all the man-in-the-middle store security breaches, I would close any store cards I had, but that's just me.Before I had student loans or a mortgage, i always paid mine off each month and still got over a 700 credit score. I still pay it off in full each month several days before the due date and there is still a balance reported. It could just be the way your card issuer reports it?

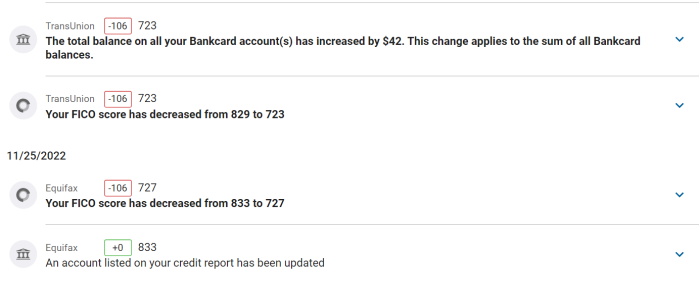

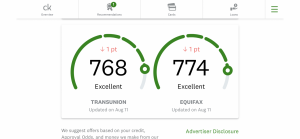

I keep hearing differing opinions on this so I figured I would ask. Pulled my credit report and saw that my credit card utilization was a 0 (which is always is being that I pay it off in full every month) and that somehow amounts to a C for that aspect of it, and that ideal credit card utilization is a 1-20% of balance utilized? Is that really the case? Should I just be keeping a 5$ balance on it month by month and just paying off whatever I charge to it? I've been paying it off in full every month since I've had the card.

did you read the rest of the your article? your hate for CCs is blinding you. what you quoted doesn't even apply to his question...

did you read the rest of the your article? your hate for CCs is blinding you. what you quoted doesn't even apply to his question...